In 2024, the issue of leaked credit cards on Twitter has gained significant attention, raising concerns about online security and financial safety. This alarming trend has left many individuals and businesses questioning the integrity of their financial information in an increasingly digital world. As we delve deeper into this issue, it is crucial to understand the implications of these leaks and the protective measures that can be taken to safeguard personal and financial data.

Credit card fraud and data breaches are not new phenomena, but the rapid spread of information on social media platforms like Twitter has made it easier for stolen information to circulate. In this article, we will explore the reasons behind the rise of leaked credit cards on Twitter, the potential impacts on victims, and the steps you can take to protect yourself from becoming a victim of credit card fraud.

By the end of this article, you will have a comprehensive understanding of the situation regarding leaked credit cards on Twitter in 2024, and how to navigate the challenges it presents. Let’s dive into the details.

Table of Contents

- Reasons for Credit Card Leaks on Twitter

- Impacts on Victims of Credit Card Leaks

- Protective Measures Against Credit Card Fraud

- Case Studies of Credit Card Leaks on Twitter

- How to Report Leaked Credit Cards

- Future Trends in Credit Card Security

- Expert Opinions on Credit Card Security

- Conclusion

Reasons for Credit Card Leaks on Twitter

The proliferation of leaked credit cards on Twitter can be attributed to several factors:

- Increased Cybercrime Activity: Cybercriminals are becoming more sophisticated in their methods, employing advanced techniques to hack databases and steal credit card information.

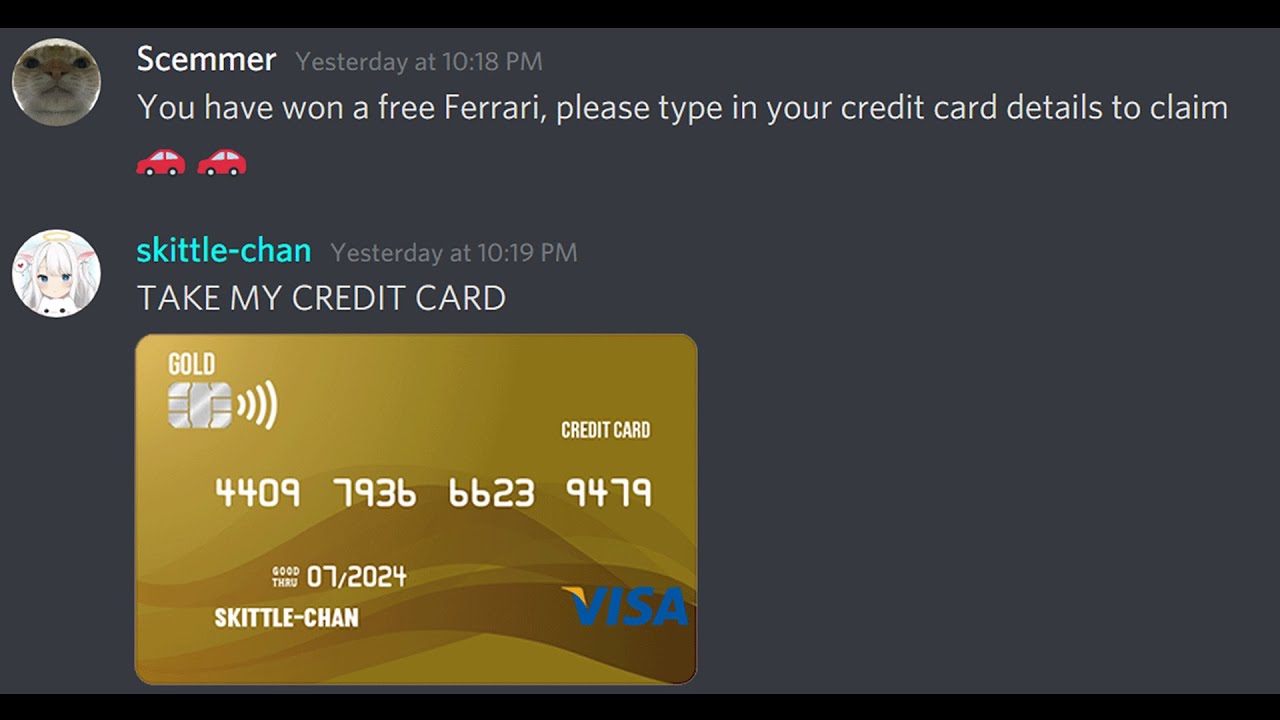

- Social Engineering Tactics: Many fraudsters use social engineering tactics to deceive individuals into providing their credit card information.

- Data Breaches: High-profile data breaches have exposed millions of credit card numbers, making them available for sale on the dark web and social media platforms like Twitter.

- Anonymous Sharing: Twitter allows users to share information anonymously, making it an easy platform for individuals to leak sensitive data without fear of repercussions.

Impacts on Victims of Credit Card Leaks

The impact of credit card leaks can be devastating for victims:

- Financial Loss: Victims may face unauthorized charges on their credit cards, leading to significant financial loss.

- Credit Score Damage: Fraudulent activity can harm a victim's credit score, making it harder to secure loans or credit in the future.

- Emotional Distress: The stress of dealing with fraud and financial insecurity can take a toll on mental health.

- Identity Theft: Leaked credit card information can lead to identity theft, where criminals use the victim's information to open new accounts or take out loans.

Protective Measures Against Credit Card Fraud

To protect yourself from credit card fraud, consider the following measures:

- Monitor Your Accounts: Regularly check your bank statements and online accounts for any unauthorized transactions.

- Use Strong Passwords: Create complex passwords and change them regularly to enhance your account security.

- Enable Two-Factor Authentication: This adds an extra layer of security to your online accounts, making it harder for fraudsters to gain access.

- Be Cautious with Personal Information: Avoid sharing sensitive information on social media and be wary of unsolicited requests for your credit card details.

Case Studies of Credit Card Leaks on Twitter

Here are some notable cases of credit card leaks on Twitter:

- Case Study 1: In early 2024, a hacker group leaked thousands of credit card numbers on Twitter, leading to widespread panic among affected individuals.

- Case Study 2: A social media influencer inadvertently shared their credit card information in a post, resulting in unauthorized charges and public backlash.

How to Report Leaked Credit Cards

If you encounter leaked credit card information on Twitter, it is important to take immediate action:

- Report the Tweet: Use Twitter's reporting tools to flag the tweet containing the leaked information.

- Contact Your Bank: Inform your bank or credit card company of any potential breaches to protect your accounts.

- File a Report: Consider filing a report with your local authorities or a cybersecurity organization.

Future Trends in Credit Card Security

The landscape of credit card security is constantly evolving:

- Enhanced Encryption: Financial institutions are investing in stronger encryption methods to protect consumer data.

- AI and Machine Learning: These technologies are being used to detect fraudulent activity in real-time.

- Consumer Education: Increasing awareness among consumers about the importance of online security is becoming a focal point for financial institutions.

Expert Opinions on Credit Card Security

Experts in cybersecurity emphasize the importance of vigilance and proactive measures:

- Dr. Jane Smith, Cybersecurity Analyst: "Consumers must take personal responsibility for their financial data by practicing safe online habits."

- John Doe, Fraud Prevention Specialist: "Businesses should invest in robust security protocols to protect customer information from breaches."

Conclusion

In summary, the issue of leaked credit cards on Twitter in 2024 poses significant risks to individuals and businesses alike. By understanding the reasons behind these leaks, recognizing their impact, and implementing protective measures, you can safeguard your financial information. We encourage you to stay informed and proactive in protecting your financial data. If you found this article helpful, please leave a comment, share it with others, or explore more insightful articles on our site.

Thank you for reading! We hope you visit us again for more valuable information on financial security and online safety.