In recent years, the issue of leaked credit cards has become increasingly prevalent, with 2024 promising to be no exception. The term "leaked credit cards" refers to the unauthorized exposure of credit card information, which can lead to significant financial loss for individuals and organizations alike. As technology advances, so do the methods used by cybercriminals, making it essential for consumers to stay informed and vigilant. In this article, we will explore the risks associated with leaked credit cards, how to protect your financial information, and the steps to take if you find yourself a victim of credit card fraud.

The rise of online shopping and digital transactions has made credit cards an integral part of our lives. However, this convenience comes with its own set of challenges. Cybercriminals are constantly seeking new ways to exploit vulnerabilities in online systems, and the leaked credit card data can be sold on the dark web for significant profits. Understanding how these leaks occur and what you can do to safeguard your information is crucial in today's digital landscape.

This article aims to provide comprehensive insights into the world of leaked credit cards in 2024. We will discuss the various types of leaks, preventive measures you can take, and the legal implications surrounding credit card fraud. By the end of this article, you will be equipped with the knowledge necessary to protect yourself and your financial information effectively.

Table of Contents

- What Are Leaked Credit Cards?

- How Do Leaks Occur?

- The Impact of Leaked Credit Cards

- Protecting Your Information

- What to Do If Your Card Is Leaked

- Legal Aspects of Credit Card Fraud

- The Future of Credit Card Security

- Conclusion

What Are Leaked Credit Cards?

Leaked credit cards refer to instances where sensitive credit card information—such as the card number, expiration date, and CVV—has been exposed or stolen. This information can be utilized by criminals to make unauthorized purchases or commit identity theft. The leaks can occur through various means, including data breaches, phishing scams, and malware attacks.

Types of Leaked Credit Card Information

- Card Number

- Expiration Date

- CVV Code

- Cardholder Name

- Billing Address

How Do Leaks Occur?

Understanding how leaked credit cards occur is essential for preventing them. The following are common methods by which credit card information is compromised:

Data Breaches

Large companies often store sensitive customer information. Cybercriminals may exploit vulnerabilities in these companies’ databases to access card information.

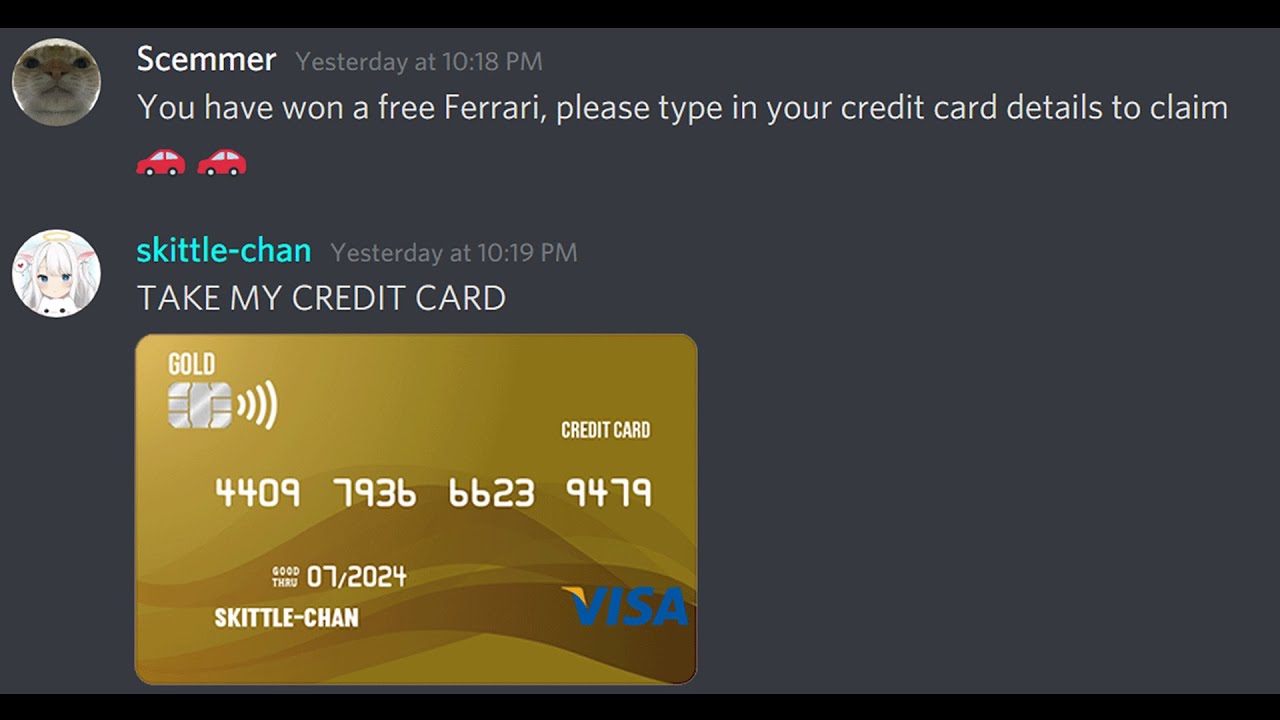

Phishing Scams

Phishing involves deceiving individuals into providing their credit card information through fake emails or websites that appear legitimate.

Malware and Keyloggers

Malware can be installed on a user’s device without their knowledge, capturing keystrokes and sending credit card information back to the attacker.

The Impact of Leaked Credit Cards

The consequences of leaked credit cards can be severe, both for individuals and businesses. Here are some key impacts:

- Financial Loss: Victims may face significant unauthorized charges on their accounts.

- Damage to Credit Score: Fraudulent activities can negatively impact an individual's credit score.

- Legal Consequences: Businesses may face lawsuits or penalties if they fail to protect customer data.

Protecting Your Information

In an age where cyber threats are on the rise, taking steps to protect your credit card information is vital. Here are some effective strategies:

Use Strong Passwords

Create complex passwords for online accounts that are difficult to guess. Use a combination of letters, numbers, and symbols.

Enable Two-Factor Authentication

Two-factor authentication adds an extra layer of security by requiring a second form of verification in addition to your password.

Monitor Your Accounts Regularly

Check your bank and credit card statements frequently for unauthorized transactions and report them immediately.

What to Do If Your Card Is Leaked

If you suspect your credit card information has been leaked, follow these steps:

- Contact Your Bank: Report the incident immediately and request a new card.

- Monitor Your Accounts: Keep a close eye on your transactions for any suspicious activity.

- Consider a Credit Freeze: A credit freeze can prevent new accounts from being opened in your name.

Legal Aspects of Credit Card Fraud

Understanding the legal implications of credit card fraud is essential for both victims and businesses. Here are some key points:

Consumer Rights

Consumers are protected by laws such as the Fair Credit Billing Act, which limits liability for unauthorized charges.

Business Responsibilities

Businesses are legally obligated to protect customer data and can face significant penalties for data breaches.

The Future of Credit Card Security

The landscape of credit card security is evolving rapidly. Emerging technologies such as biometric authentication, chip technology, and artificial intelligence are being integrated to enhance security measures. Understanding these advancements can help individuals and businesses stay ahead of potential threats.

Conclusion

In conclusion, the issue of leaked credit cards is a growing concern as we move into 2024. By understanding the risks and implementing protective measures, individuals can safeguard their financial information. It is crucial to stay informed about the latest trends in credit card security and to take proactive steps to mitigate risks. If you found this article helpful, consider sharing it with others or leaving a comment below. Together, we can work towards a safer financial future.

Thank you for reading! We hope to see you back here for more insightful articles on financial security and protecting your personal information.